- 904-648-6488

- [email protected]

- 120 Palencia Village Dr., Ste. 105-377 St. Augustine, FL 32095-8549

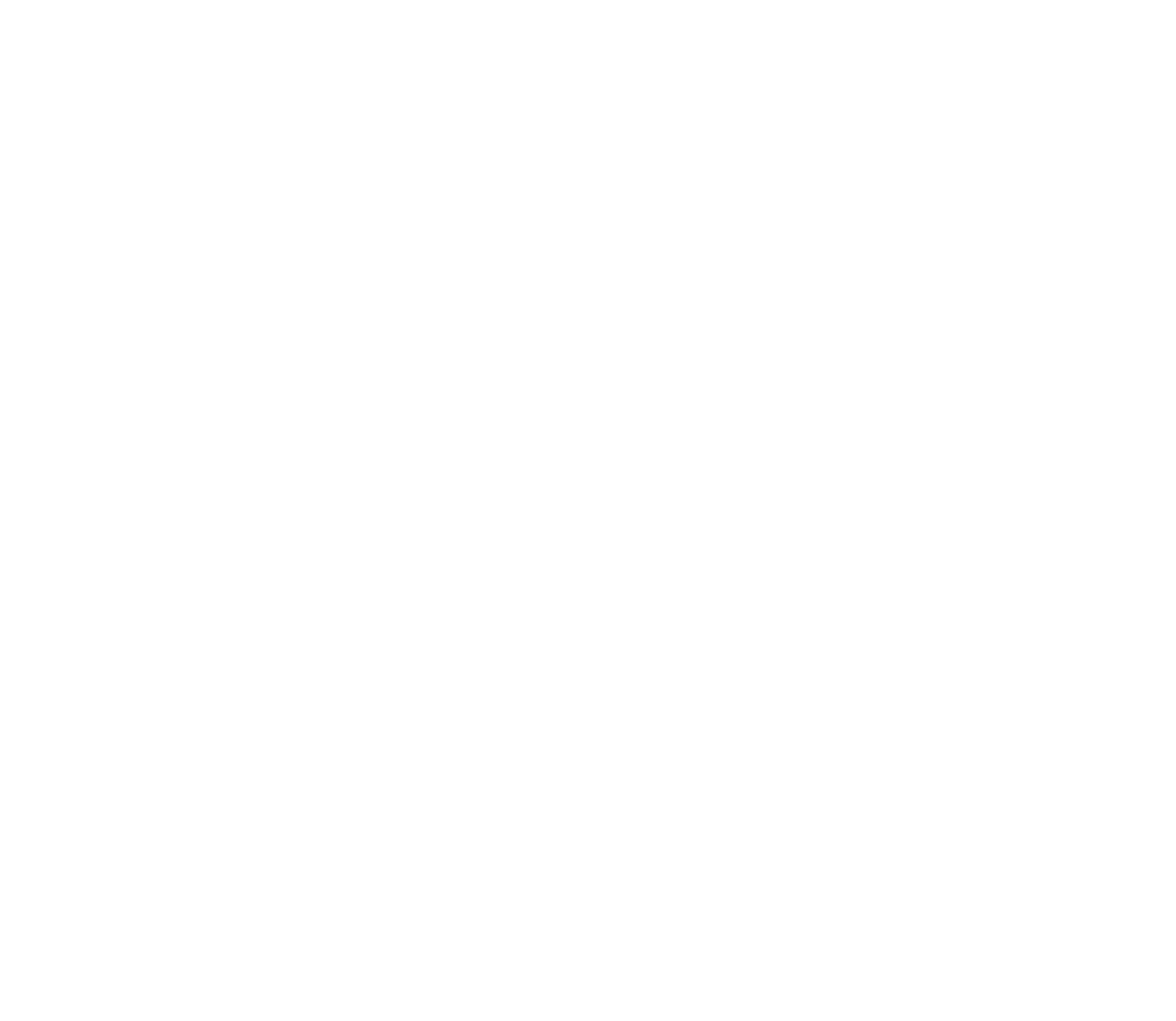

You have choices in how you can get your Medicare coverage.

Ask Carol B will review each of your options in detail.

There are two main ways to get your Medicare coverage – Original Medicare with add-on Drug and Medicare Supplement Plans OR Medicare Advantage.

This coverage includes:

Part A premium: Usually $0 cost / month

Standard Part B premium: $170.10* / month

Helps cover:

For an extra premium, you can add a Med Supp plan

Helps cover:

For an extra premium, you can add a stand-alone PDP plan

Original Medicare is a federal health insurance program for eligible U.S. citizens and legal residents. It is funded in part by the FICA taxes you pay while working. It is individual health insurance that generally has a cost for each service. Here are the general rules for how it works: In most cases you can go to any doctor, health care provider, hospital, or facility that is enrolled in Medicare and accepting new Medicare patients. With a few exceptions, most prescriptions aren’t covered in Original Medicare. You can add drug coverage by joining a Medicare Drug Plan (Part D). In Original Medicare you don’t need to choose a primary care doctor or get a referral to see a specialist.

You generally pay a set amount for your health care (deductible) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (coinsurance / copayment) for covered services and supplies. There’s no yearly limit for what you pay out-of-pocket. Part B has a premium and if your income is over a certain threshold, you may have to pay an additional amount called an IRMAA. You generally don’t need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

* Rate for 2022. Most people pay the Standard B premium amount. If your modified AGI (Adjusted Gross Income) as reported on your IRS tax return from 2 years ago is above a certain amount, we will need to send you the chart outlining the extra charge added to your premium called IRMAA.

This coverage includes:

Part A premium: Usually $0 cost / month

Standard Part B premium: $170.10* / month

Medicare Advantage Plan: $0.00-$depends on your zip code

Helps cover:

Most plans include Drug coverage.

Helps cover:

Most plans include extra benefits.

A Medicare Advantage Plan is another way to ge your Medicare Part A and Part B coverag. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D). In most cases, you’ll need to use health care providers who participate in the plan’s network. These plans set a limit on what you’ll have to pay out-of-pocket each year for covered services. Some plans offer non-emergency coverage out of network, but typically at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white and blue Medicare card in a safe plave because you’ll need it if you ever switch back to Original Medicare.

If you join a Medicare Advantage Plan, you’ll still have your Medicare but you’ll ge most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

* Rate for 2022. Most people pay the Standard B premium amount. If your modified AGI (Adjusted Gross Income) as reported on your IRS tax return from 2 years ago is above a certain amount, we will need to send you the chart outlining the extra charge added to your premium called IRMAA.

This coverage includes:

Part A premium: Usually $0 cost / month

Standard Part B premium: $170.10* / month

Medicare Advantage Plan: $0.00-$depends on your zip code

Need a Stand-alone Prescription Drug Plan in addition

Helps cover:

For an extra premium, you can add a Med Supp plan

Helps cover:

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. Medicare Supplement Insurance (Medigap) policies sold by private companies, can help pay some of the remaining health care costs for covered services and supplies, like copayments, coinsurance, and deductibles.

Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. Generally, Medigap doesn’t cover long-term care (like care in a nursing home), vision or dental services, hearing aids, eyeglasses, or private-duty nursing.

Medigap plans are standardized. Medigap must follow federal and state laws designed to protect you, and they must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a “standardized” plan, identified in most states as plans A – D, F, G and K – N. All plans offer the same basic benefits, but some offer additional benefits so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap plans are standardized in a different way.

* Rate for 2022. Most people pay the Standard B premium amount. If your modified AGI (Adjusted Gross Income) as reported on your IRS tax return from 2 years ago is above a certain amount, we will need to send you the chart outlining the extra charge added to your premium called IRMAA.

This coverage includes:

Part A premium: Usually $0 cost / month

Standard Part B premium: $170.10* / month

Medicare Advantage Plan: $0.00-$depends on your zip code

Helps cover:

Most plans include Drug coverage.

Helps cover:

Most plans include extra benefits.

Medicare drug coverage (Part D) helps pay for prescription drugs you need. Even if you don’t take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare. If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join the plan later. Generally, you’ll pay this penalty for as long as you have Medicare drug coverage.

To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage. Each plan can vary in cost and specific drugs covered.

There are 2 ways to get Medicare drug coverage (Part D):

In either case, you must live in the service area of the plan you want to join and be lawfully present in the U.S.

* Rate for 2022. Most people pay the Standard B premium amount. If your modified AGI (Adjusted Gross Income) as reported on your IRS tax return from 2 years ago is above a certain amount, we will need to send you the chart outlining the extra charge added to your premium called IRMAA.

AskCarolB puts you at the center of everything we do. As licensed agents, we will guide you through the Medicare maze at no cost. We work with the top carriers in the nation to tailor a plan that meets your needs at the lowest price available.

AskCarolB truly cares that you are protected as you age. We provide clarity and security in the choices made.

AskCarolB.com is owned and operated by Ask a Friend, Inc., and is a privately-owned website. This Website serves as an invitation for you, the customer, to inquire about further information regarding Medicare Supplement Insurance, Medicare Advantage and Prescription Drug Plans, as well as Marketplace and Ancillary Health Insurance plans and submission of your contact information constitutes permission for a licensed sales agent to contact you with further information, including complete details on cost and coverage of this insurance. Individual products and features are subject to availability and may vary by state according to the carrier’s plan options. Premiums are based on ZIP code, age, household discounts and tobacco use and are not a guarantee of cost reduction.

This is a solicitation for insurance. Although we are contracted with many carriers, this is not a complete listing of plans available in your service area. For a complete listing please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. AskCarolB.com markets a portfolio of a wide variety of health insurance and supplemental insurance products such as on and off-exchange health, dental, vision, hearing, indemnity plans, long term care, final expenses, etc. AskCarolB.com’s quoting platforms do not include all health insurance companies or all available insurance products.